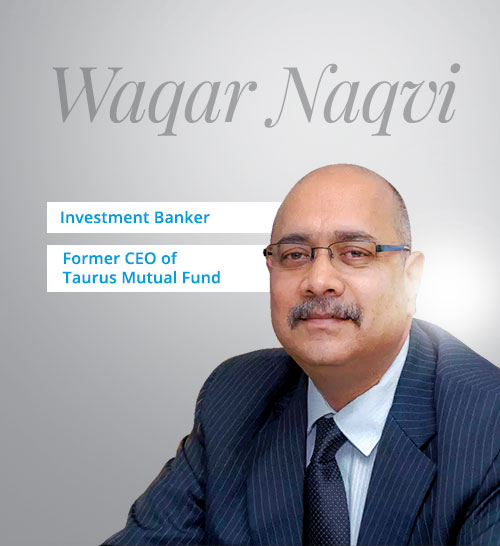

Waqar Naqvi holds a first-class MBA in Finance and is an Associate member of the Institute of Cost Accountants of India (ICAI). Formerly the CEO of Taurus Asset Management Company Limited, he has an extensive 33-year background in financial services, having launched his career with Thermax Limited, a leader in industrial equipment manufacturing. Over the years, he has held prominent positions across several reputable firms, including GE Transportation Financial Services Limited, Aditya Birla Sun Life Asset Management Company Limited—a joint venture between India’s Aditya Birla Group and Canada’s Sun Life Financial—and Taurus Asset Management. At Aditya Birla Financial Services, he served as Vice President & Business Head of Offshore Funds and Specialty Businesses, with a seven-year tenure encompassing Regional/Country Head and Business Head roles.

At 39, Naqvi became one of the youngest CEOs, leading Taurus AMC for over 14 years. He has a strong understanding of domestic and international markets, portfolio management, gold funds, real estate, and other financial products, overseeing areas such as investment management, compliance, finance, operations, and client servicing. Taurus AMC under Mr. Naqvi’s leadership was known as one of the most profitable and innovative AMC. His consistent high performance, extensive industry network, and experience building and leading large teams are complemented by his skills in regulatory and stakeholder relationship management. He has lectured and trained in India and abroad, written newspaper articles, and served as a judge for startup competitions. He is also a former Chairman of the Association of Mutual Funds of India ARN Committee and a past member of the Advisory Committee at O.P. Jindal University. Notably, he conceived and launched India's first open-ended Sharia-compliant equity mutual fund for Taurus AMC.

After his CEO tenure, Naqvi served as an Independent Director and Trustee on the board of L&T Mutual Fund Trustee Limited, overseeing L&T Mutual Fund’s operations.

Present: He is a Director at Friends of Forces Foundation Ltd., a Designated Partner of Right Standard Ventures LLP, where he provides strategic consulting and investment banking services to medium-scale enterprises. Mr. Naqvi after setting up Right Standard Ventures has been instrumental in helping a few mid-sized corporates to list on the Indian Stock Exchanges with more listing in the pipeline.

Social Cause: With a strong commitment to give back to the society Mr. Naqvi has been a catalyst as well as a principal to achieve the same. In line with his philosophy of going about it with humility and silently, Mr. Naqvi is keen not to speak loudly about it.

Having qualified as a Cost and Management Accountant in 1991 and having completed his Masters in Business Administration with a specialisation in Finance and Marketing, shortly afterwards, Mr. Naqvi embarked on his journey of being a corporate professional. The first stop was the finance department of Thermax Limited a company known for its engineering achievements and industrial products however Mr. Naqvi soon realised that he is better off marrying his understanding of finance/economics with his people management skills and with his passion to innovate.

With Financial Services opening up in India Mr. Naqvi moved to Apple Finance Limited, a leading Non banking Finance Company (NBFC) of its time and excelled in their Corporate Finance Division.

From Apple Finance Limited, Mr. Naqvi having caught the eye of competitors decided to join GE Transportation Financial Services Limited (GE TFS) the Indian NBFC of GE Capital, the largest Financial Institution in the world at that time. With 3 promotions in 2 years under his belt in GE TFS in Central India, Mr. Naqvi decided to move to Mumbai (that time Bombay) which is the commercial and financial capital of India and joined Escorts Finance Ltd., another leading NBFC of its time.

Joined Escorts Finance Limited as Head of Mumbai and later on handled credit and recovery as well for the Mumbai region. After a year and a promotion was posted as Head of Escorts Consumer Credit Limited (ECCL), a subsidiary of Escorts Finance Limited. Headed the Company (ECCL) successfully for a year before deciding to move to the Dotcom space.

With the dotcoms humming by that time and picking up the best of talent, Mr. Naqvi decided to take the plunge and joined Triedge Business Solutions Limited, a B2B business solution provider as the Head of their Business Development.

With the Dotcom space in slow mode Mr. Naqvi moved back to financial services and joined the reputed Aditya Birla Financial Services as the Eastern Region Head of their NBFC arm before moving within an year on promotion to their Mutual fund arm as Head of North India for Aditya Birla Sun Life Asset Management Company Limited after which he was given the charge of North plus South India before being promoted to Country Head - Institutional Business. From this position Mr. Naqvi was elevated to the position of Head of Offshore Funds and International Funds apart from Speciality Businesses and he was instrumental in growing the Dollar denominated funds of the Mutual Fund making it the largest Dollar denominated fund in India in 2007. Mr. Naqvi also helped launch a debt fund in Canada and oversaw the Mauritius based funds of Aditya Birla Sun Life AMC getting them listed in Singapore as well as in other geographies.

In 2008 Mr. Naqvi joined Taurus Asset Management Co Ltd. (Taurus Mutual Fund) and made Taurus the fastest growing MF in India post which the change of economic conditions made Mr. Naqvi to exchange growth for profit thereby giving up fast growth in size to make Taurus the most profitable Mutual Fund in India on the basis of its ratios. Taurus MF was also where Mr. Naqvi innovated products which had a combination of Gold, Equity and Debt and under Mr. Naqvi’s leadership Taurus MF conceived and launched the first open ended equity shariah fund in India.

After having spent 13+ years at Taurus MF as Chief Executive Mr. Naqvi decided to set up his own venture in Investment banking and christened it as Right Standard Ventures LLP. Right Standard helps promising Mid sized corporates to get listed on the Indian Stock Exchanges and acts as a strategic advisor to them for the same. With a few listings to its credit and more in the pipeline, Right Standard Ventures LLP has established its own place in the Indian Corporate World.